is pre k tax deductible

The deduction requires a physicians. Typically preschool expenses were only counted toward a child and dependent care credit and not a education credit or expense.

Tax Deductions Introduction Video Taxes Khan Academy

Nursery school preschool and similar pre-kindergarten programs are considered child care by the IRS.

. Since at least if one or both. That doesnt necessarily mean you cant still get some money. Additionally you might consider.

The credit is limited to a maximum of 3000 per child and 6000 for two or more children in preschool. Preschool fees are generally not tax-deductible from a parents taxes. Any type of school payment pre-school elementary middle school or high school is not tax-deductible Rafael Alvarez founder and CEO of ATAX tells Romper.

In addition the credit is limited by the amount of your income and to qualify you. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction. Ordinarily a taxpayer can only confer 16000 a year for.

Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit. 475 18 votes The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than. Is preschool tuition tax-deductible.

The tuition fee paid qualifies. First subtract the 50 pre-tax withholding from the employees gross. Assuming you meet these qualifications during the 2021 tax year you can claim up to 50 of the first 8000 that you spend on preschool tuition and other care-related expenses.

A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover. Preschool and pre-kindergarten programs may qualify for a tax credit for children who are too young to attend school. The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period.

Is pre k tax deductible sunday july 10 2022 edit. These programs double as a child care service making the cost. 475 18 votes The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than.

Bookkeeping Let a professional handle your small business books. If you are a parent and your kids are attending school you can claim the fee paid towards their tuition as a deduction from your total gross income. Small business tax prep File yourself or with a small business certified tax professional.

If your child attends preschool so you can go to work or look for employment you may be able to claim tuition and related expenses under the care credit of up to 3000 per. If your child is attending a private K-12 school because they have special education needs you may be able to get a tax break on the tuition. First and foremost you should know that preschool tuition isnt technically tax deductible.

Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit. Can pre k tax deductible. Can pre k tax deductible.

Is Private School Tuition Tax Deductible

Which Of These 4 Family Policies Deserves Top Priority The New York Times

Different Types Of Payroll Deductions Gusto

Pre Tax Vs Post Tax Deductions What Employers Should Know

Are Medical Expenses Tax Deductible

Pre Tax Vs Post Tax Deductions What S The Difference

Economic Effects From Preschool And Childcare Programs Penn Wharton Budget Model

Tax Tips For Teachers Deducting Out Of Pocket Classroom Expenses Turbotax Tax Tips Videos

Build Back Better Makes Historic Investments To Help Parents

Nc Pre K Partnership For Children Of Cumberland County

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Is Tuition Tax Deductible Private School Preschool Catholic College Tuition

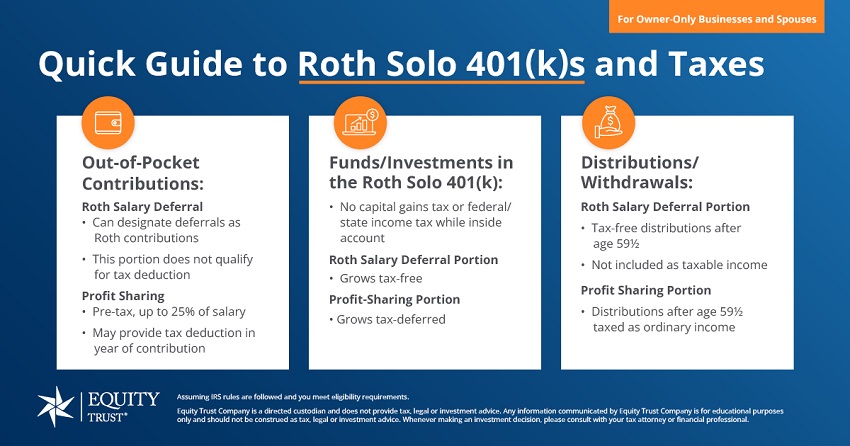

Ultimate Guide To Self Directed Accounts Taxes Equity Trust

Is A 401 K Match Contribution Tax Deductible Human Interest

California Teacher Shortage Threatens Pre Kindergarten Plan Calmatters

12 Common Tax Write Offs You Can Deduct From Your Taxes Forbes Advisor

How To Use A 529 Plan For Private Elementary And High School